Regulators introduce new rules each year, and violations can trigger fines or unwanted audits. Organizations struggle to track changing requirements or keep documents in order.

A regulatory compliance solution helps organize obligations and confirm that daily practices follow legal standards. It also reduces the chance of penalties that interrupt business operations.

In this guide, you’ll learn what these tools do and why organizations rely on them. You’ll also see a list of leading options to support your compliance program.

What Is a Regulatory Compliance Solution?

A regulatory compliance solution is software that helps a company follow the laws and regulations in its industry. It stores compliance requirements, documentation, and tasks in one platform.

The software supports compliance management across finance, health, supply chain, human resources, and procurement.

It also helps teams track regulatory changes. Records stay up to date for each jurisdiction in which the company operates.

Most platforms use automated workflows for evidence collection, approvals, training, and assessments. These tools support governance and reporting.

They also help teams confirm that internal controls work as intended.

Benefits of Using Regulatory Compliance Software

Regulatory compliance software helps a company manage legal obligations and daily compliance processes in a more organized way.

These benefits highlight how these systems support teams across different parts of the business.

- Risk management: The software helps teams identify issues early and assess how those issues affect operations. This helps the company choose realistic ways to mitigate risks before they escalate.

- Regulatory updates: The system tracks changes to federal rules and industry regulations. Companies with a global network can keep requirements up to date without manual research.

- Automated workflows: Automation routes tasks, organizes reviews, and supports routine monitoring. Teams avoid repetitive work and focus on decisions that require judgment.

- Evidence and case management: The platform organizes documents requested by auditors and keeps related records in order. Teams can move through audit reviews without delays.

- Governance support: The system tracks compliance activity and produces reliable reporting. Decision-makers gain insight into program performance and can respond to issues with greater awareness.

These advantages help companies stay organized and aligned with changing regulatory expectations.

Top 5 Regulatory Compliance Solutions in 2026

Companies rely on different compliance software based on industry rules, internal processes, and regulatory pressure.

Below are five widely used options that support documentation, audits, risk activity, and core compliance tasks.

1. TLM

Total Lean Management (TLM) is management software that complies with the International Organization for Standardization (ISO) and Food and Drug Administration (FDA) guidelines.

Compliance teams use it to organize documentation, audits, approvals, and quality processes. This helps organizations maintain consistent procedures and stay compliant with the standards that govern their industry.

TLM also supports risk and compliance activity through its Risk and Opportunities module. Teams can assess severity and likelihood, review risk priority number (RPN), and link evaluations to projects or procedures.

This helps organizations review their risk responses and keep related records connected to the right processes.

Key Features

- Central platform for quality and corporate compliance processes

- Document control with version tracking and electronic signatures

- Change control linked to standards and related modules

- Build your own Custom Forms with email notification and approvals

- AI-Powered compliance reviews and document content searching

- Audit planning, findings, and follow-up task management

- Support for ISO 9001, ISO 13485, ISO 17025, and FDA expectations

- Dashboard with task summaries for compliance teams

- On-premise or cloud deployment

- Multi-factor authentication

- Reporting tools for quality management system (QMS) data

- Integration through Connection Manager for enterprise resource planning (ERP) and accounting systems

- Validation documentation packages for regulated industries

Risk and Opportunities Management

This TLM module helps teams record evaluations across severity, likelihood, and detection when needed. It also supports before and after RPN values so teams can compare mitigation steps.

Evaluations connect to projects, procedures, and assets. This keeps risk activity tied to related work. Some evaluations can also appear automatically when specific events occur in other modules.

Security and Validation

TLM keeps its hosted data within the United States. It follows strict cybersecurity controls across both deployment options.

Companies that follow ISO 13485 or FDA expectations can use TLM’s validation documentation packages during inspection preparation.

These materials help teams meet regulatory expectations without building validation content from scratch.

Put TLM’s compliance and quality tools to the test. Book a demo or launch a 30-day trial to see the software in action!

2. Ardoq

Image source: ardoq.com

Ardoq helps organizations map regulatory requirements to the systems, data flows, and processes they rely on. It’s useful for teams that want to see how rules connect to applications and internal operations.

The platform supports frameworks such as the Digital Operational Resilience Act (DORA), Gramm-Leach-Bliley Act (GLBA), and CPS 230.

Compliance teams can model each requirement and link it to the right components. They can also confirm that their processes continue to meet those obligations when the company updates its technology or workflows.

Key Features

- Central hub for mapping regulations across multiple frameworks

- Workspaces for regulations, risks, and internal policies

- Connections between obligations, systems, roles, and data flows

- Automated calculations for likelihood, exposure, and related values

- Evidence storage for audit documentation

- Alerts for outdated information

- Role-based access and collaboration tools

- Survey features for collecting input across teams

- Reuse of requirements across different frameworks

- Framework-agnostic setup for standard and custom regulations

Strengths and Limitations

Ardoq helps clients understand how regulations tie into applications and data flows. It also supports decision-making by showing how changes in one area influence related components.

Teams that manage several regulations can reuse information across frameworks, which reduces repeated work.

However, the platform can feel complex for users who haven’t worked with Enterprise Architecture tools.

Users report a learning curve when they handle large sets of information or detailed modeling views. Advanced integrations may also require help from technical staff.

3. NAVEX

Image source: navex.com

NAVEX offers governance, risk, and compliance (GRC) tools for organizations that manage several regulations across different departments.

It supports rules from the FDA, the Occupational Safety and Health Administration (OSHA), and the Sarbanes-Oxley Act (SOX).

The platform brings policies, training, incident reporting, and regulatory updates into one system. This helps teams manage their compliance needs with a clearer view of changing obligations.

NAVEX One, the company’s main platform, also uses AI features to highlight risk areas and support faster reviews.

Key Features

- Tools for documenting exception events and corrective actions

- Notifications for changing regulatory requirements

- Case assignment across teams and departments

- Whistleblower and hotline capabilities

- Training programs for regulatory and workplace topics

- Third-party and vendor monitoring

- Reporting across risk and compliance activity

- Integrations with other business systems

- AI-driven insights for risk identification

Strengths and Limitations

NAVEX helps organizations manage policies, training, and incidents. It gives teams better visibility into regulatory tasks. This can support companies that work with several regulations at the same time.

Despite that, clients say the interface feels rigid and doesn’t offer much customization. Policy review can also take time when teams manage large document libraries.

Users mention slower support responses during complex issues, which may require extra help when the system is first introduced.

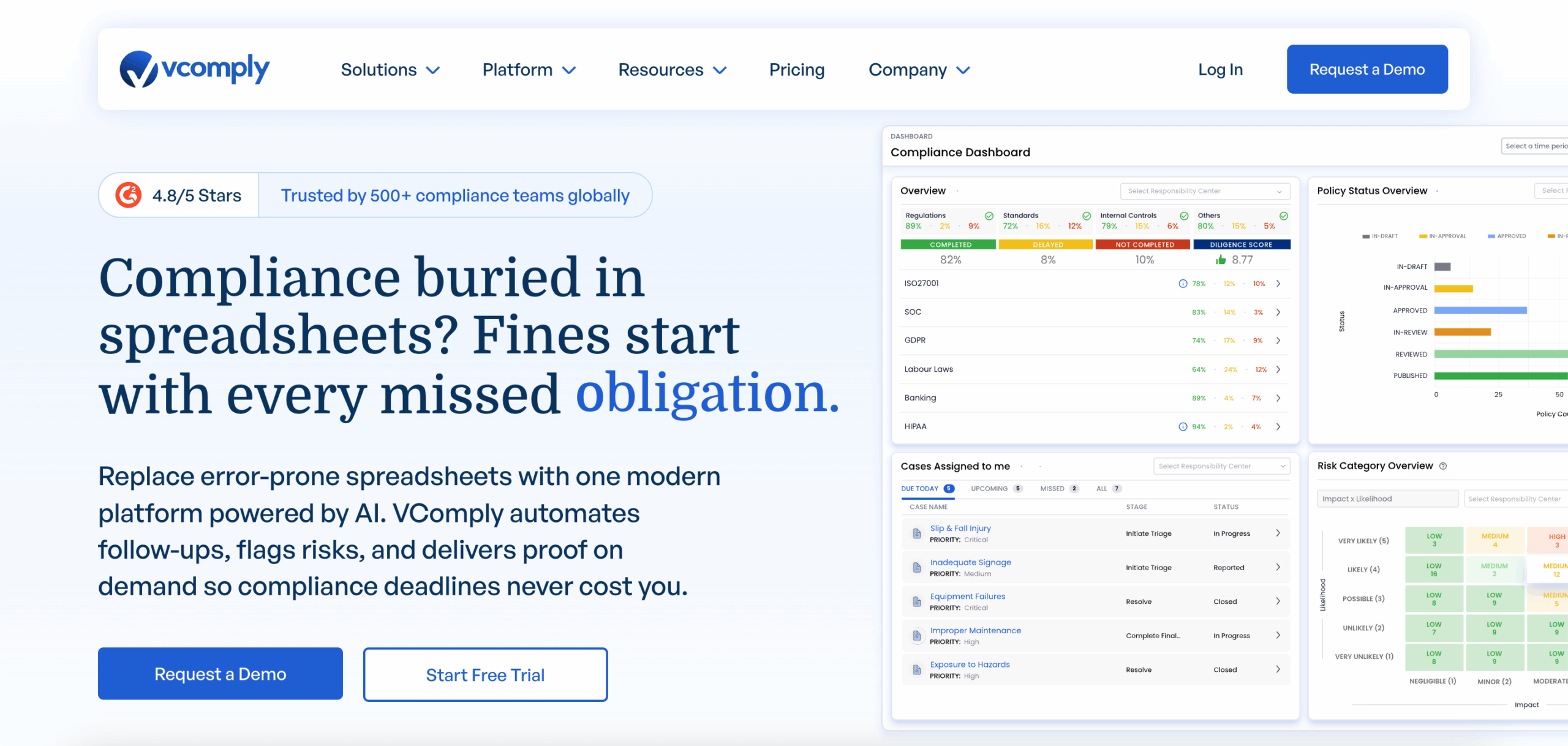

4. VComply

Image source: v-comply.com

VComply is a GRC platform that helps organizations manage policies, audits, risks, and tasks. It supports teams that want a structured way to define controls and assign responsibilities.

Dashboards and heatmaps give users visibility into risk scores, audit results, and open items. The platform also maps controls to frameworks such as ISO, OSHA, and Securities and Exchange Commission (SEC) guidelines.

VComply helps teams establish consistent processes by routing updates through workflows and keeping all compliance records in a central location.

Key Features

- Workflows for approvals, updates, reviews, and recurring responsibilities

- Dashboards and heatmaps for risk and compliance visibility

- Evidence collection through file uploads and linked documents

- Calendar tools for scheduling compliance and audit work

- Alerts for deadlines and overdue tasks

- Control library mapped to regulatory frameworks

- Automation for inherent and residual risk scoring

- Reporting tools for compliance and audit status

- Integration options for syncing calendars and internal systems

- Audit logs for tracking activity over time

Strengths and Limitations

VComply helps teams stay organized by turning regulatory requirements into assigned tasks with clear owners and deadlines.

It supports efficiency by centralizing evidence, assignments, and audit information. Dashboards give leaders quick insight into compliance activity.

At the same time, clients report delays when recurring responsibilities update across cycles. Others mention small file transfer errors or limited task assignment options.

Some teams also want more customization in the interface. Certain implementations may take longer and need coordination with VComply’s internal development or support services.

5. Resolver

Image source: resolver.com

Resolver is a risk and compliance platform that centralizes information from audits, incidents, threats, and regulatory updates. It helps teams review how different risks influence daily operations.

The system also sends alerts when new requirements apply to a specific region or business type. This supports organizations that work across several jurisdictions or financial institutions.

Its AI features summarize changes in plain terms, so teams don’t have to sort through long documents to understand what shifted.

Resolver also links regulatory obligations to related activities, assigns updates to the right teams, and provides a live risk matrix that shows changing risk levels.

These functions help organizations manage complex compliance programs without relying on separate tools.

Key Features

- AI summaries for new requirements to highlight changes

- Alerts tied to region or business type for targeted updates

- Links between obligations and related activities for context

- Workflow builder with no code setup for custom processes

- Task routing for reviews and approvals across teams

- Dashboards and reports for program visibility

- Whistleblowing and case management for issue tracking

- Internal audit management for planned and ongoing reviews

Strengths and Limitations

Resolver gives teams a connected view of risks, policies, tasks, and regulatory updates. Targeted alerts help teams focus on items that apply to their business.

Dashboards also show program activity in one place, which helps leaders review progress.

Still, some users report a long setup period before the system is fully configured. Others mention slower performance with complex analysis or large data sets.

Reporting can also feel limited for teams that want more advanced layouts, and some reporting tools require an add-on service.

Let TLM Support Every Part of Your Compliance Processes

Regulatory programs demand steady coordination across audits, policies, risk reviews, and documentation. Most organizations work under ISO or FDA expectations, and they need a system that supports those requirements.

TLM brings these duties into one platform so teams can review records, prepare for audits, and manage quality activity without separate systems.

TLM supports ISO and FDA standards. It also provides one location for audit tasks, document control, and quality program updates.

The Risk and Opportunities module uses the RPN to help teams review severity and likelihood in a single view. Users can record their plans and track how each choice guides future work.

TLM adapts to many industries through custom fields and system settings. Companies in healthcare, insurance, manufacturing, and medical devices report smoother audit preparation after they adopt the platform.

Schedule a demo to see how TLM supports your compliance program. You can also start the 30-day trial and explore the system in your own environment!

FAQs About Regulatory Compliance Solutions

What is a regulatory compliance solution?

A regulatory compliance solution is software that helps organizations follow the laws, standards, and rules that apply to their industry.

It centralizes tasks like documentation, policy updates, audit preparation, and risk review to help teams manage regulatory duties.

How to solve regulatory compliance?

Organizations solve compliance challenges by creating a clear process for tracking rules and updating internal policies. They also review risks on a regular schedule.

Many teams use compliance software like TLM to manage these duties in a central system. This helps them stay current with regulations and keep records ready for internal or external checks.

What is an example of regulatory compliance?

A healthcare company that follows the Health Insurance Portability and Accountability Act (HIPAA) is one example.

The company protects patient information, follows reporting rules, and maintains documented procedures that match federal expectations.

Why is a compliance officer calling me?

A compliance officer may call to confirm that your work follows company policies or regulatory requirements.

They may also need details for an audit, a policy review, or a check on a specific task. This helps the organization verify that its obligations are met.

Demos

Demos